What is the difference between a Trial balance and Balance sheet

A trial balance is an intermediate step in the accounting cycle and serves as a worksheet. It lists all the general ledger accounts of a company and their respective balances—debits on one side and credits on the other.

It acts as a preliminary check to detect any errors or discrepancies in the recording of financial transactions before preparing financial statements.

Here are some key points about a trial balance:

1. Balancing Tool: It helps ensure the accuracy of the accounting records by verifying that the total debits equal the total credits.

2. Temporary Report: It is not a financial statement, but a tool used during the preparation of financial statements.

3. Timing: It's prepared at the end of an accounting period, typically monthly, quarterly,

or annually.

4. Includes All Accounts: Both nominal (revenue, expenses, etc.) and real (assets, liabilities, equity) accounts are listed in the trial balance.

Balance Sheet:

On the other hand, a balance sheet is one of the core financial statements that provide a snapshot of a company's financial position at a specific point in time. It presents the assets, liabilities, and equity of a business, detailing what the company owns, owes, and its net worth. Unlike the trial balance, the balance sheet is a formal financial statement used for external reporting to stakeholders like investors, creditors, and regulators.

Key aspects of a balance sheet include:

1. Financial

Snapshot: It summarizes the financial health of a company at a specific date, showing assets on one side and liabilities plus equity on the other side.

2. External Reporting: It's a document prepared for external parties, showcasing the

company's financial position, and aiding in decision-making.

3. Fixed Structure: The balance sheet has a standard format with assets listed on the left-hand side and liabilities plus equity on the right-hand side.

4. Permanent Record: It forms a part of the company's financial statements and is published along with other statements like the income statement and cash flow statement.

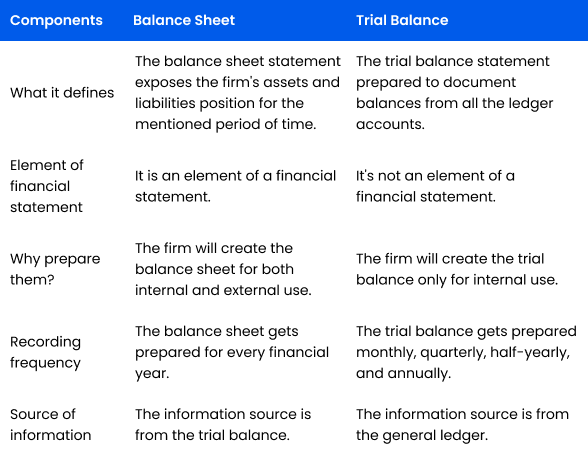

Difference between Trial Balance and Balance Sheet:

- Purpose: The trial balance checks the mathematical accuracy of accounting records, whereas the balance sheet presents the financial position of a company at a specific point in time.

- Nature: Trial balance is an internal document used for verifying accuracy, while the balance sheet is an external financial statement meant for stakeholders

- Timing: The trial balance is prepared periodically during the accounting cycle, while the balance sheet is prepared at the end of a reporting period.

- The trial balance is prepared periodically during the accounting cycle, while the balance sheet is prepared at the end of a reporting period.

- Content: The trial balance lists all ledger accounts and their balances, while the balance sheet summarizes assets, liabilities, and equity in a structured format.

Trial Balance:

Trial balance is an intermediate process in the accounting cycle and its purpose is to ensure equality of debits and credits in the accounting system. It serves as a preliminary check to check the accuracy of accounting records. The trial balance lists all the ledger accounts and their balances, ensuring that the total debits and total credits are equal. It is a temporary report prepared before preparing the financial statements.

Balance sheet:

It presents the statement of assets, liabilities, and equity, showing the amount of assets, outstanding balance, and total value of assets of the company. A balance sheet is a formal financial statement displayed for external reporting to stakeholders.

Differences between

Trial balance and balance sheet:

- Purpose: The trial balance checks the accuracy of the accounting system, while the balance sheet shows the financial position of a company.

- Types: A trial balance is an internal instrument, whereas a balance sheet is an external financial statement.

- Timing: The trial balance is prepared during the accounting cycle, while the balance sheet is prepared at the end of the reporting period.

.png)

.png)